Affluent Investor Snapshot 2024[@affluent-investor-snapshot-2024]

We surveyed over 11,000 affluent individuals across 11 markets and asked some simple yet important questions about investment behaviours worldwide.

The Power of Portfolio Diversification

Avoiding the pitfall of putting all your eggs in one basket.

By Willem Sels

Global Chief Investment Officer,

HSBC Global Private Banking and Wealth

Diversification involves spreading your investments across a wide range of assets to minimise the risk associated with concentrating too heavily on any single investment. A common strategy is to expand your stock portfolio beyond just a few stocks and includes bonds and other asset classes to diversify further.

Why is this a good idea? Primarily because the world is unpredictable. If we could accurately predict which investment would perform best over the next 3, 6, or 12 months, we might place a substantial bet on that asset. However, in reality, it would still be a gamble, as investing involves numerous uncertainties. Even with thorough analysis and a deep understanding of the stock you choose, unexpected events can still occur.

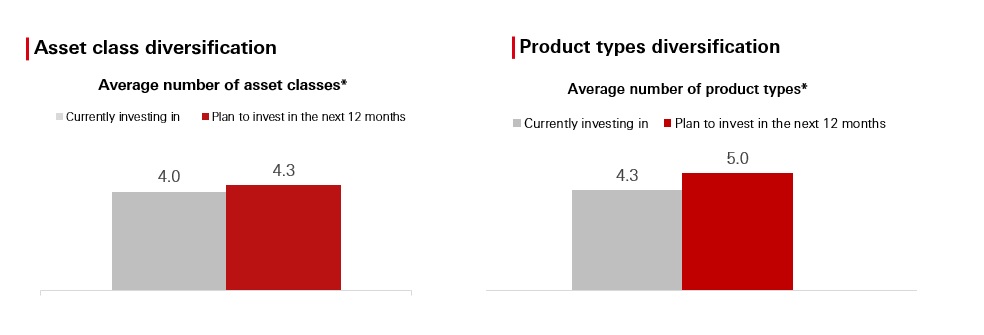

The positive news is that investors are looking to diversify further. In our latest Affluent Investor Snapshot 2024, we found that mass affluent investors typically own four asset classes and just over four investment products on average, but also plan to further diversify their portfolios in the next 12 months.

Diversification matters

Let's explore why portfolio diversification is important. When all your eggs are in one basket, a single unexpected event can shatter them all if the basket falls. For example, the impact of firm-specific risks, such as management change, factory accidents or bankruptcy, can be diversified away by investing in a larger number of stocks. Diversification gets even more powerful, if we look for stocks in different sectors or countries, because shocks in one sector or country may not affect others. Think of rising commodity prices, which may affect industrial companies but not banks. And from a geographical perspective, think of elections or flooding, which typically only have a relatively local impact.

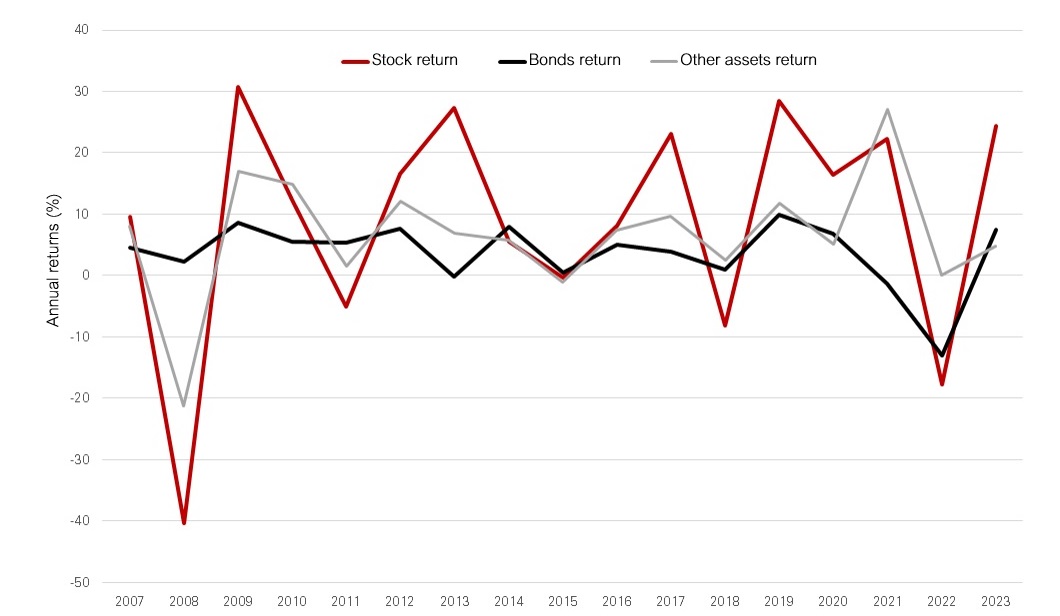

Adding bonds and other asset classes such as precious metals or commodities also makes sense because they tend to react differently to what is going on around us. A slowing economy is typically bad for stocks but can support government bonds and gold. Rising inflation can be bad for bonds but good for gold, while energy and materials stocks could be quite resilient. Again, if we knew for certain how the economic data releases would turn out in the next 3, 6 or 12 months, we could take a concentrated position. But in our uncertain world, diversification across these asset classes can reduce portfolio volatility.

Different asset classes react differently to market and economic situations. It’s key to have a diversified portfolio to weather market volatility.

Expanding the opportunity set

Finally, diversification is also about widening the opportunity set. It would be a pity to only look at companies in your own country, or in the sector you’re most familiar with. The world is full of opportunities and innovations that allow companies to grow and investors to thrive. Moreover, if you’re living in a developed market, it’s hard to match the growth rates of the emerging markets. And by considering different asset classes, investors can tailor how much they want to focus on interest income, dividends, capital gains and foreign currency exposure.

So, diversification is the key to building resilient portfolios and to seizing opportunities. Although stock pickers with concentrated portfolios can sometimes get lucky and outperform diversified portfolios, this tends to be temporary. In the long run, diversification helps support steadier performance through different market conditions.

What does our Affluent Investor Snapshot tell us?

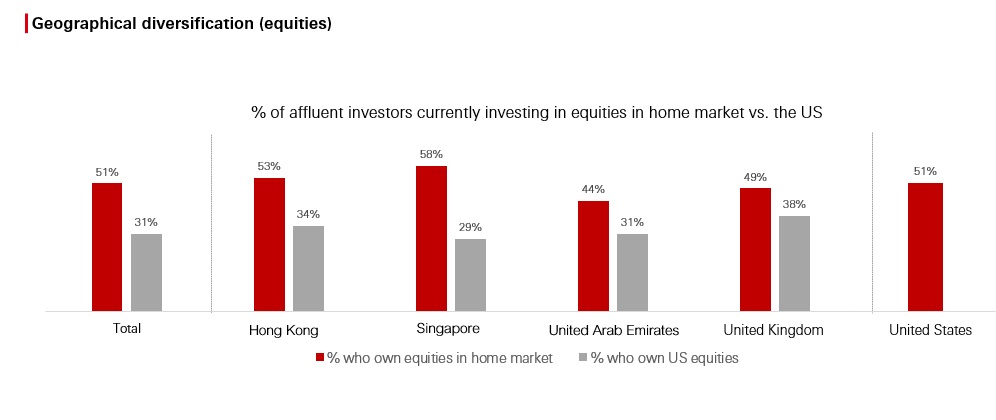

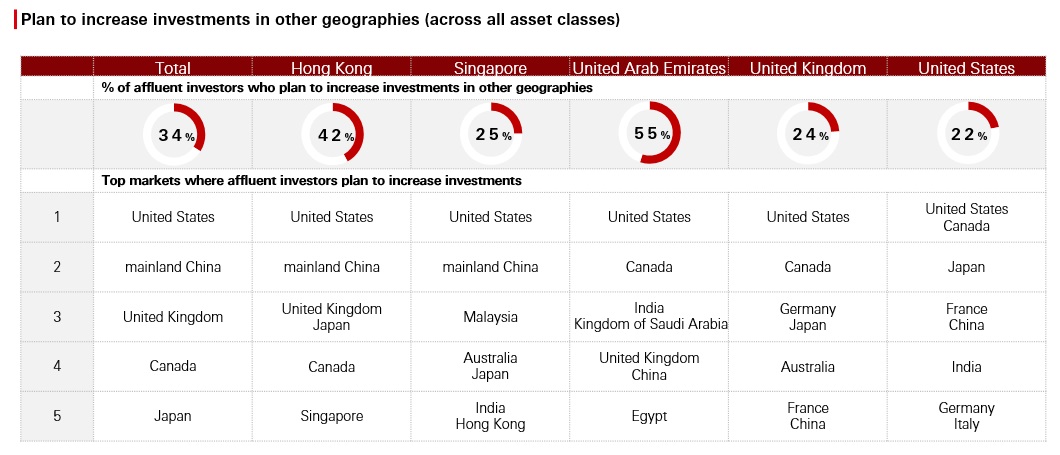

A third of affluent investors have equity exposure to the US. And one-third of the affluent investors in the major international wealth centres are keen to invest in other markets.

Beyond home market

Many investors have 30-60% of their stocks in their home market, even in relatively small economies. Familiarity and the desire to limit currency risk may be key drivers of this. But there is a clear concentration risk here, as a slowdown in your home economy could impact your work, your business and your investments in a relatively correlated fashion. Global diversification can help, and understandably, many investors choose the US as their first port of call, thanks to its liquid and large equity market and the familiarity of its biggest stocks. In Asia, we have been diversifying actively, as the structural opportunities in China follow different drivers than in India, while Japan is coming out of its deflationary period and South Korea benefits from the renewed pick-up in IT demand. These markets’ uncorrelated economic cycles, and their different sector compositions provide great diversification.

36% of affluent investors find difficulty in monitoring & managing a diversified portfolio and 45% of the affluent investors are uncertain about the market conditions

Achieving financial confidence

It’s true that more diversified portfolios need adequate tracking and require the expertise to understand other markets. Professional management and good reporting are key to providing the comfort investors need. But there’re uncertainties at home too, and when venturing abroad, risks can be managed by looking for the highest-quality assets available.

This highlights the need to adapt portfolio construction to investors’ age, needs, risk level and preferences. While everyone is different, older investors often need more income and stability, which can favour a higher allocation to bonds and cash. Other investors who are willing to take more risk will be more tempted to take equity and emerging market risks and venture away from home. It’s best to discuss different options with your relationship manager to find out what works best for you. Product choice can help ease investors’ concerns too, as equity funds and multi-asset funds, for example, offer diversification and can benefit from the manager’s local market expertise.

What is the current outlook?

As markets conditions change, it will make sense to make tactical tweaks to the diversified portfolio that works best for you. For example, the current elevated yields on high-quality bonds can be locked in to create an attractive income stream for portfolios. In equity markets, we believe the economic cycle and earnings environment are most positive for US stocks and those of selective Asian countries such as Japan, India and South Korea. We believe the current supportive environment provides a broad range of options for investors to put their cash to work more effectively and construct well diversified portfolios.

Diversify your wealth portfolio with a range of Unit Trust funds

Find out your Quality of Life score