Table of contents

Moving money

Who can I make payments/transfers to?

You can:

- make peer-to-peer payments to your friends and family with DuitNow

- send money to your saved payees using DuitNow Pay-to-Account (Instant Transfers) or Interbank GIRO (IBG) from your local or foreign currency accounts

- pay bills to your saved payees

- pay bills with JomPAY

The options to make future dated and recurring payments such as standing instructions are currently not available. To make such payments, log on to HSBC online banking.

Interbank

You can:

- make peer to peer payments to your friends and family with DuitNow

- send money to someone new or your saved payees via DuitNow or Interbank GIRO (IBG)

Intrabank

You can:

- transfer funds between your own local or foreign currency accounts

- send money to someone new or your saved payees in local or foreign currency accounts

Bill payments

You can:

- pay bills to your saved payees via JomPAY

Additional fraud counter-measures

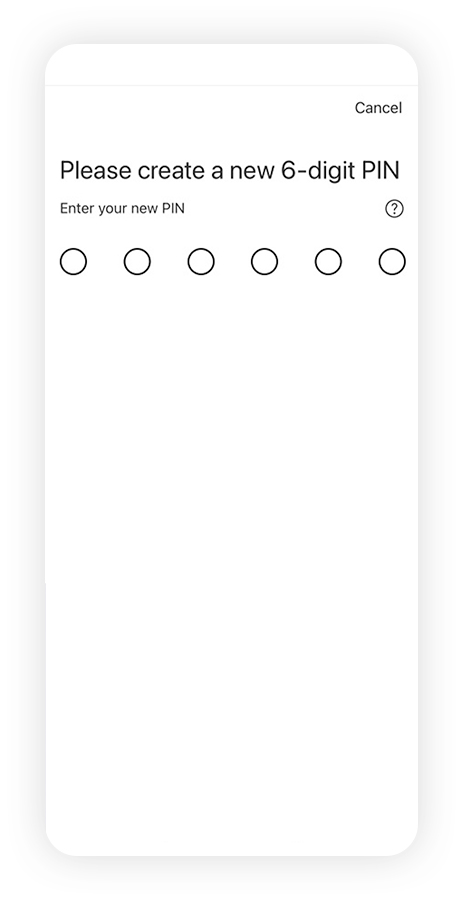

From 13 November 2024 onwards, we'll need your biometric or 6-digit PIN authentication for any of the following transactions via the HSBC Malaysia Mobile Banking app:

- Payment or transfer exceeding RM10,000 between your own HSBC accounts

- Payment or transfer to a saved payee for any amount

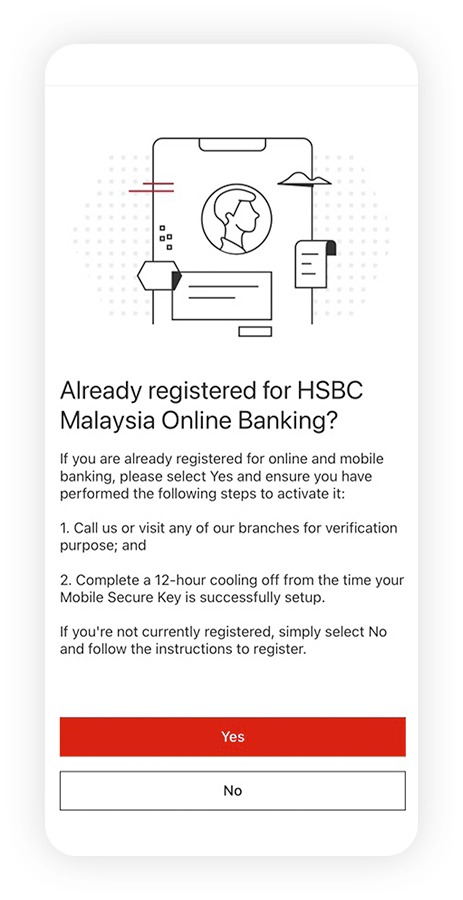

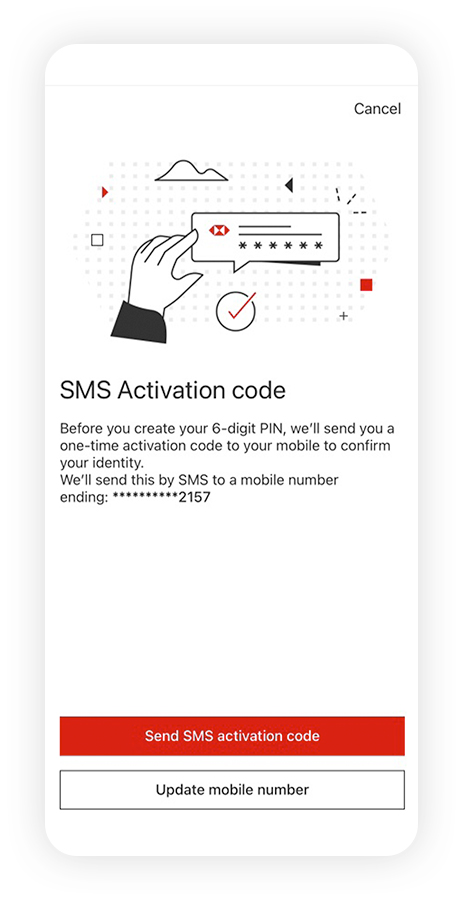

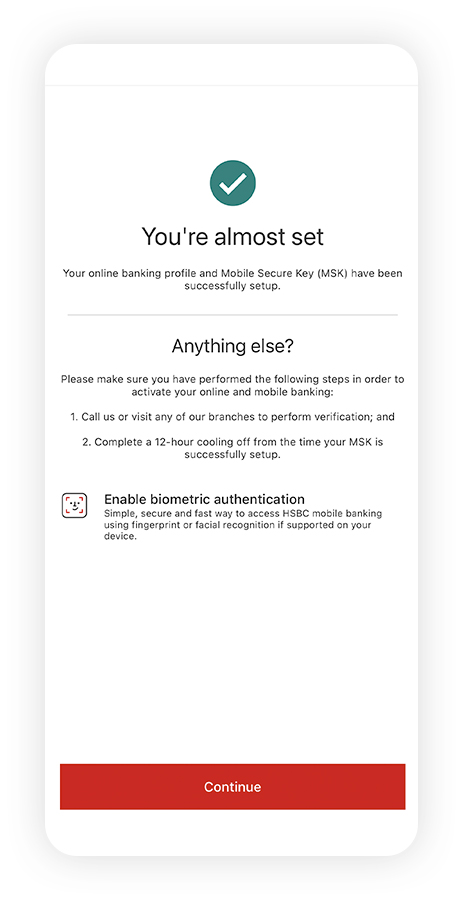

There's a 12-hour cooling-off period for your Mobile Secure Key set-up.

Please note that there's a 12-hour cooling-off period for Mobile Secure Key set-up.

DuitNow

Why should I use DuitNow?

With DuitNow, you can send and receive money instantly at any time using the recipient's DuitNow ID such as their mobile number, NRIC number, passport number, Business Registration Number (BRN) or Army/Police number. You won't need their account details to make a transfer.

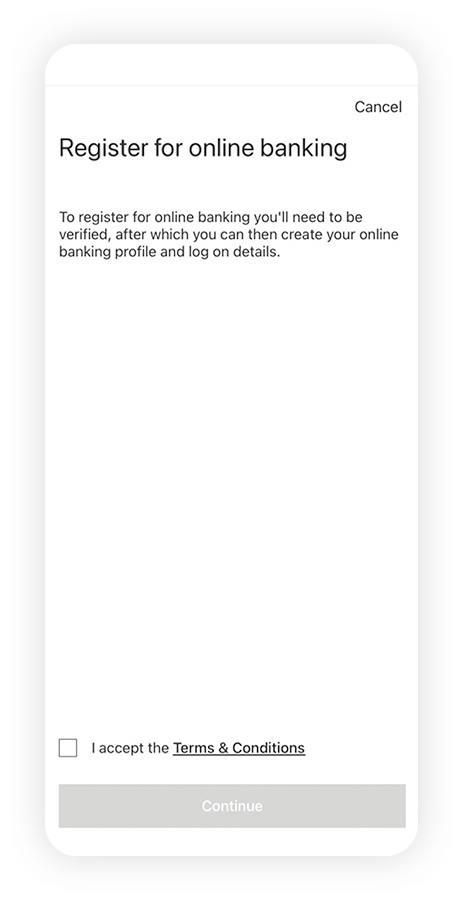

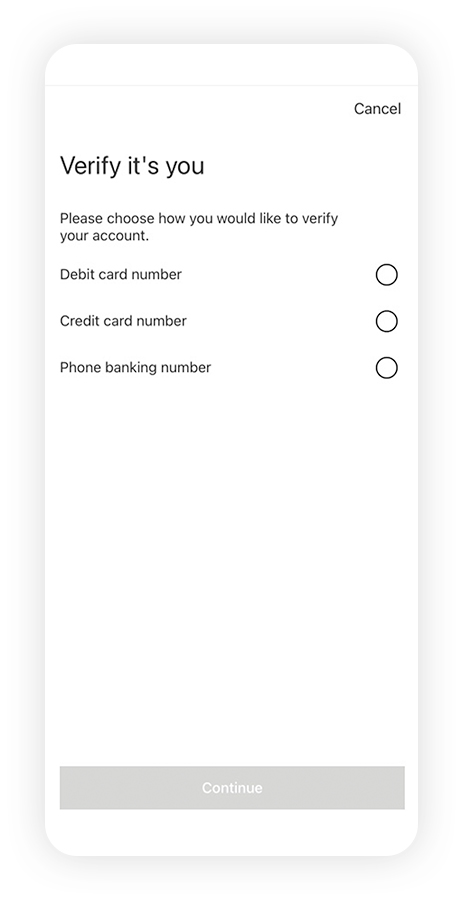

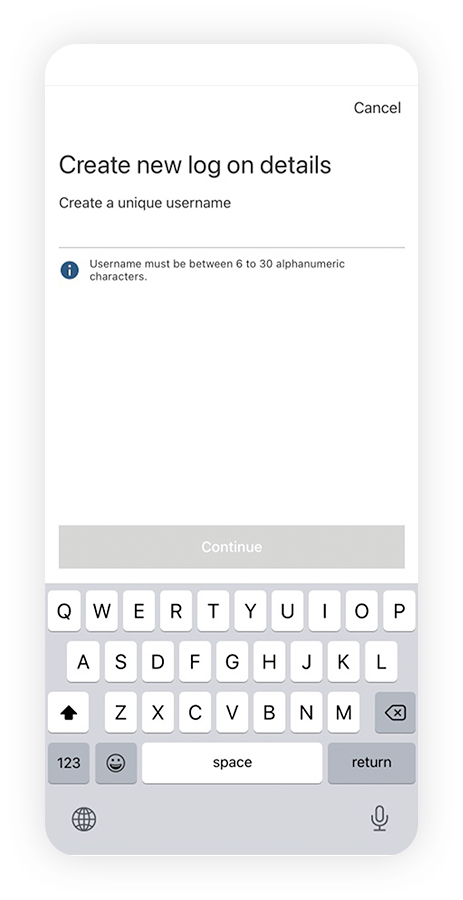

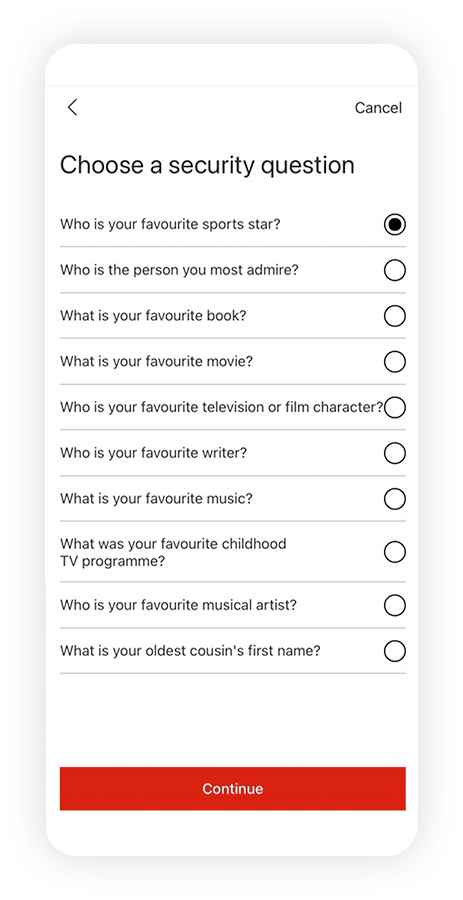

Mobile registration

Why should I register for online banking using the HSBC Malaysia Mobile Banking app?

1. Why should I register for online banking using the HSBC Malaysia Mobile Banking app?

Using the app lets you protect your banking activity with 6-digit pin for mobile banking and activate a Mobile Security Key (MSK). Your MSK generates a unique, one-time security code which you can use to log on to online banking, confirm transactions, and access the full range of online banking services.

Protecting your Android devices from malware

From 28 May 2024 onwards, we'll roll out a new safety measure to the Android version of the HSBC Malaysia Mobile Banking app. This will help us better protect you from potential fraud due to malware. So if you’ve turned on accessibility permissions for certain apps on your Android device, you won't be able to use the HSBC Malaysia Mobile Banking app. You'll get an alert about this before the app closes. To open the app and continue using it, you must turn off the accessibility permissions for those apps and / or uninstall them.

eStatements

How can I view my eStatements using the HSBC Malaysia Mobile Banking App?

i. After logging on, select the credit card or banking account for which you want to view statements

ii. Click on the "View statements" icon

iii. Click on the date of the statement you want to view

iv. The statement will load shortly

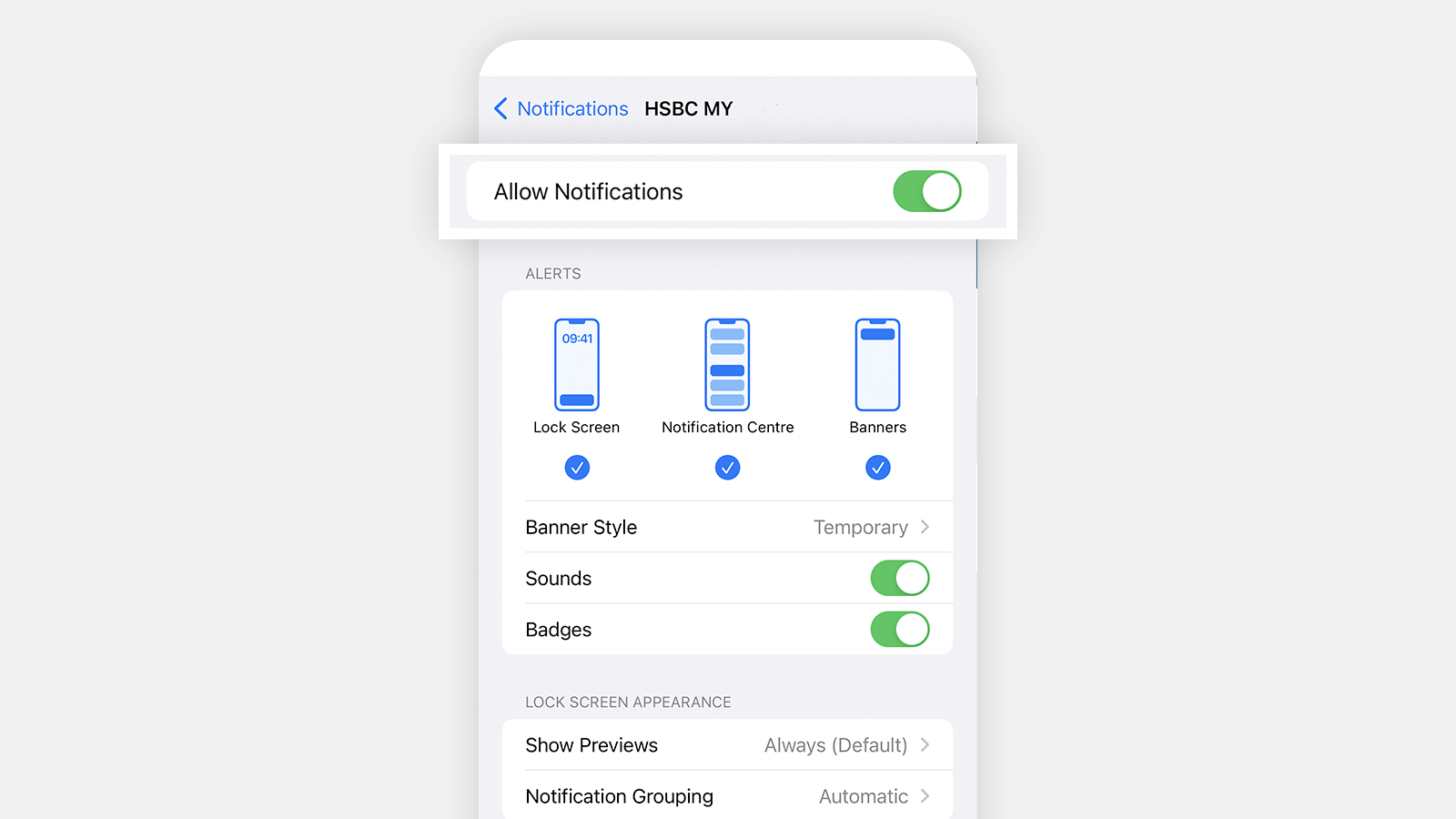

Push notifications

What's a push notification?

A push notification is an alert you may receive on your mobile device from the HSBC Malaysia Mobile Banking app if you've enabled your Mobile Secure Key and push notifications.

- Log on to the app.

- Select your profile icon at the top right corner of the ‘Home’ page.

- Find 'Communication preferences'.

- Choose 'Push notification preferences'.

- Select ‘Turn on notifications’.

When you tap on an HSBC Malaysia Mobile Banking app push notification on your mobile device, you'll be prompted to log on to the app to see the details.

When will I receive notifications?

You will receive notifications when:

- You've made specific types of transactions using your credit card/-i, including your supplementary cards (learn more about alerts for specific types of transactions)

- Your latest paper or e-statement for your credit card/-i is ready

- There are personalised offers or promotions, if you’ve opted in to receive marketing communications from us

We will be introducing more notifications soon to help you keep track of your accounts.

If you turn push notifications off, you'll be receiving updates via SMS for credit card/-i transaction alerts and statement reminders.

If you do not wish to receive notifications for personalised offers, go to the HSBC Malaysia website and select Important Information > Help > Subscription to marketing communication to unsubscribe. You can also visit your nearest branch or call our Contact Centre to unsubscribe.

Mobile provisioning

What devices support the HSBC Malaysia Mobile Banking app?

From 28 May 2025, the app supports the following devices and operating systems:

- iPhones with iOS 15 or above

- Androids with Android 12 or above

Cooling-off period

What is the cooling-off period?

It's a 12-hour period of time that happens after you've set up your Mobile Secure Key. The cooling-off period will be put in place for all MSK set-ups from 22 August 2023.

Why is there a cooling-off period?

This is an enhanced security measure which protects you from fraud and keeps your account safe. If you get an SMS from us saying your Mobile Secure Key has been set up, but you didn't authorise this, you can report this to us during this time period.

Mobile authentication

I am unable to proceed with setting up / provisioning my HSBC Malaysia Mobile Banking app and I am using an Oppo R9sk device. What should I do?

Please check which operating system you are using on your phone. You will need to be using the latest Android operating system to enable you to use the HSBC Malaysia Mobile Banking app. This should be Android OS 9 or above.

Recurring and future transfers

Can I schedule credit card payments ahead of time?

No, we only support future dated or recurring transfers between accounts.

Location permission

Do I have to provide the HSBC Malaysia Mobile Banking app with my location?

No, this is a voluntary decision to help enhance the security of your online banking experience. You can disable/enable location permission services to the HSBC Malaysia Mobile Banking app at any time by going into the 'Manage security' settings page on the app.

iNPS customer survey

Do I have to take the customer survey?

No, this is a voluntary decision for you to share your feedback about the HSBC Malaysia Mobile Banking app.

Real time transactions (RTT)

When will pending transactions show up on my HSBC Malaysia Mobile Banking app?

Both pending and posted transactions will show on your mobile app on the transaction date (not posting date) in the order they were carried out.

Redeeming your rewards

What is mobile reward redemption?

Customers are now able to keep track of Reward points and submit redemption requests through HSBC Mobile Banking app. Currently, this feature is available for HSBC TravelOne only credit card. To learn more, please visit respective credit card web pages.