Table of contents

- Logging on to online banking

- Online banking registration

- Resetting your online banking password

- Activating your Security Device

- Account summary

- Payments and transfers

- Online banking limits

- Daily combined limit

- Time/Term Deposit/-i

- Manage future requests / recurring payments

- Manage your payees

- Secure messages

- Linking your global accounts

- JomPay

- DuitNow

- DuitNow Online Banking/Wallets

- FPX

- Communication preferences

- Online banking service features for HSBC/HSBC Amanah

- Cut-off times

Logging on to online banking

How do I access HSBC Malaysia online banking services?

You can access our online banking services through the HSBC or HSBC Amanah website.

From 30 June 2025, only access HSBC Malaysia Online Banking from these web browsers:

- Google Chrome (version 131 and later)

- Microsoft Edge (version 133 and later)

- Mozilla Firefox (version 133 and later)

- Safari (version 16 and later)

- Opera (version 115 and later)

You will not be able to access HSBC Malaysia Online Banking if you are not using any of the five supported browsers and versions mentioned above.

Please ensure that your web browser is up to date to ensure uninterrupted access and safeguard your transactions on HSBC Malaysia Online Banking.

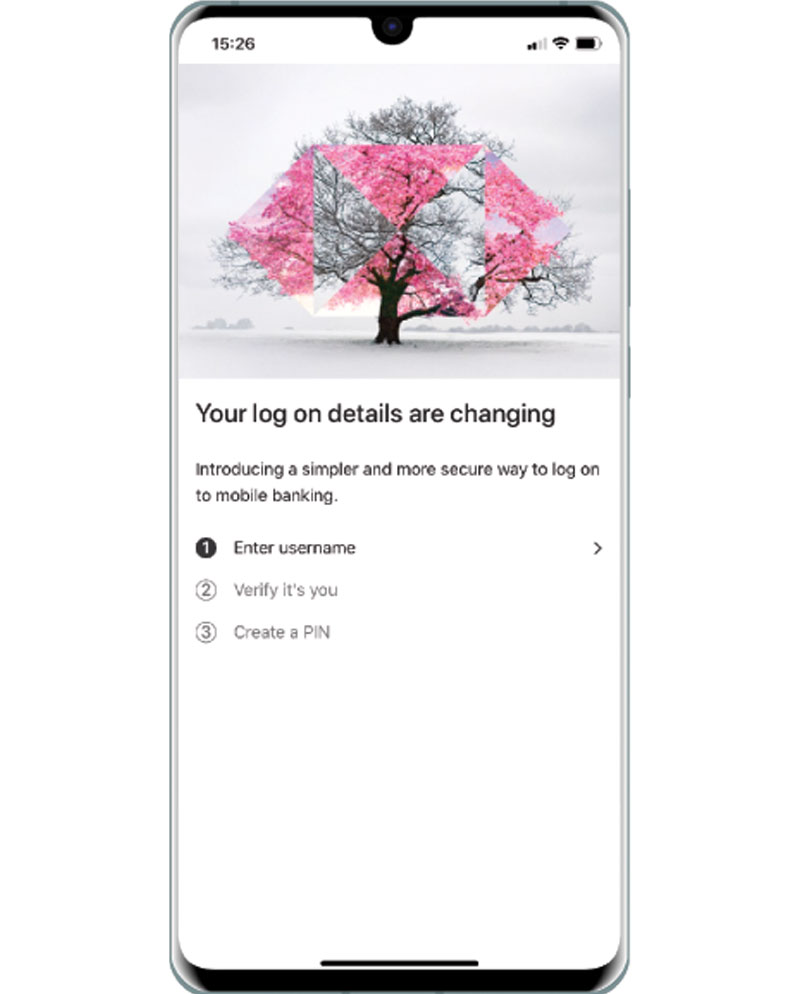

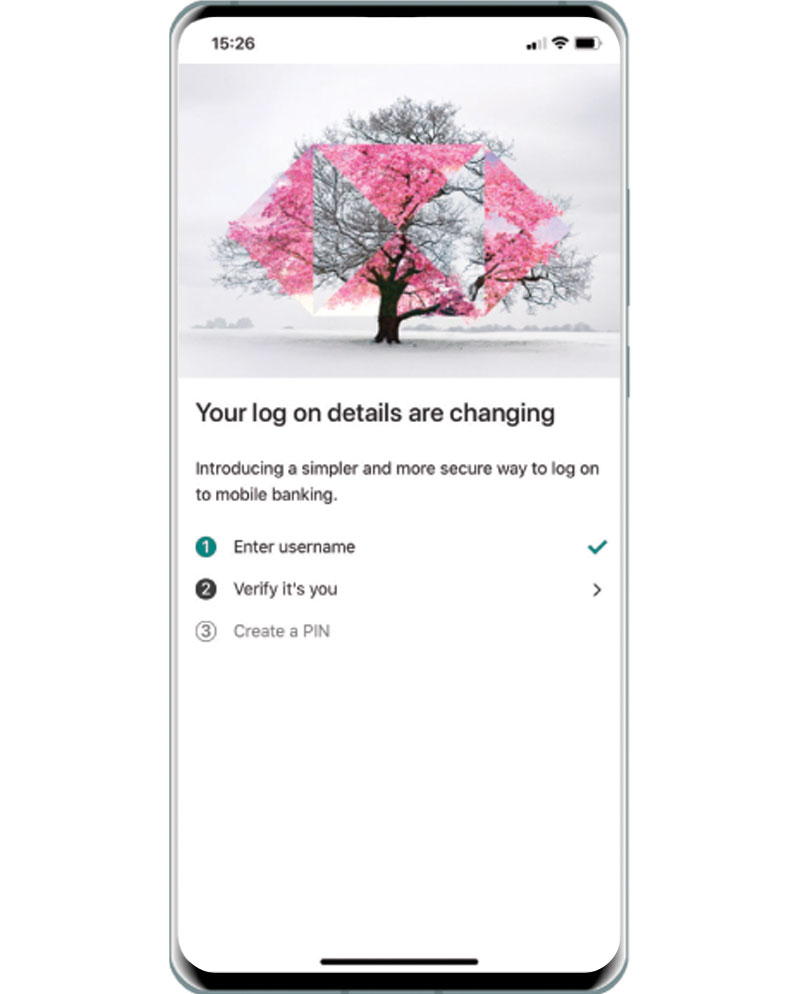

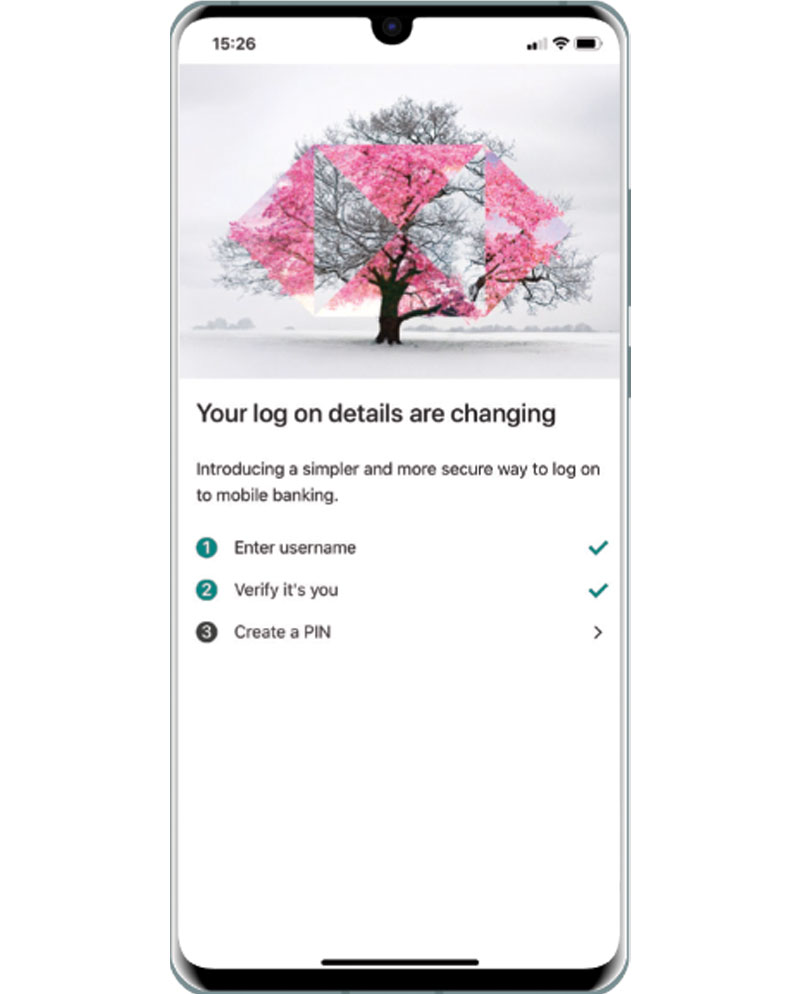

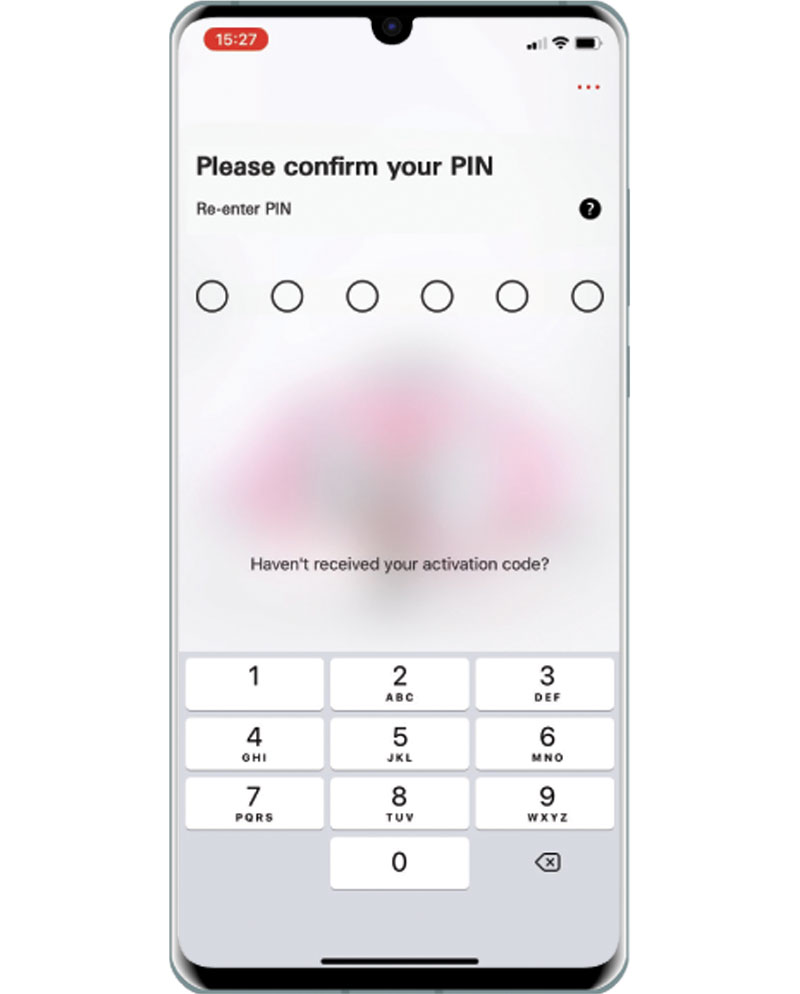

Online banking registration

How do I register for online banking?

You need to have a bank account with us to register for online banking. If you're a current bank customer, you can register with your phone banking number, debit card number or credit card number.

You can set up online banking using the HSBC Malaysia Mobile Banking app. Scan this QR code to download the app, or search 'HSBC Malaysia' in your phone's app store.

You can also select 'Register' at the top of any page on our website, or select it in the menu if you're on mobile.

Resetting your online banking password

How do I reset my password?

You may change your password by selecting 'Forgotten password'.

You must first log out, then select 'Log on' > Type in your username > Select 'Forgotten password'. Next, follow the on-screen instructions to reset your password via the self-service options or with help from the HSBC Contact Centre.

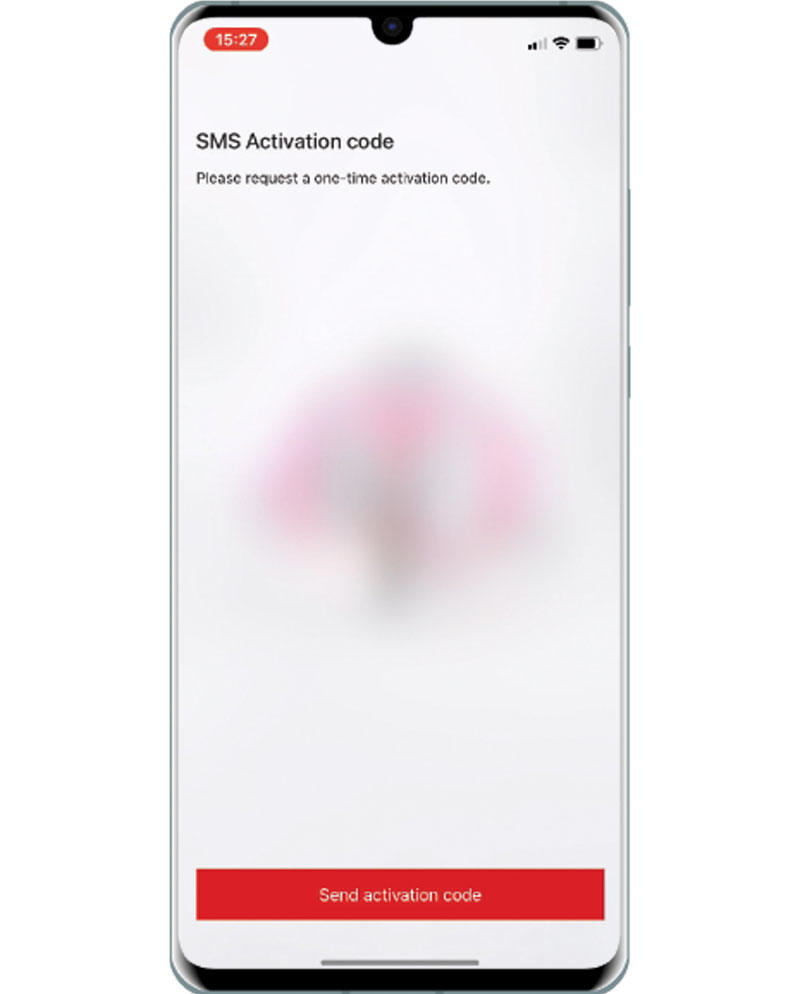

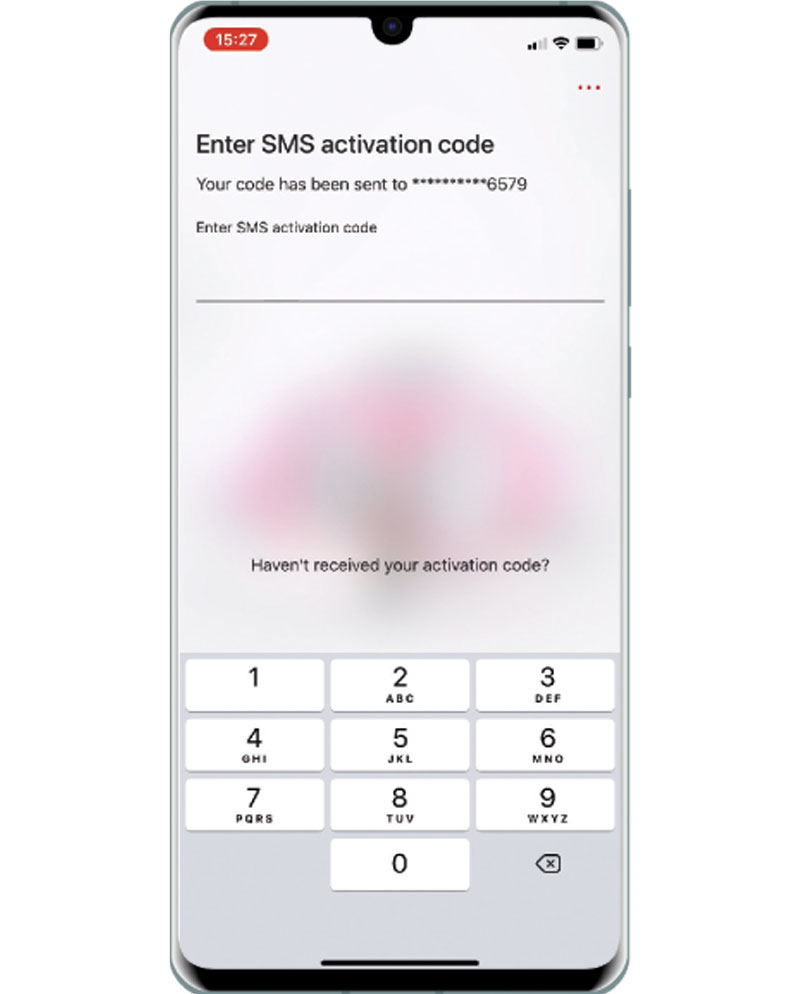

Activating your Security Device

How do I activate my Security Device?

Follow these 6 steps for device activation:

- After you log on to online banking, and enter your user ID and password, you'll be asked to enter an activation code generated from an SMS OTP.

- Separately, enter the 10-digit serial number located on the back of your Security Device on the online banking page.

- Press and hold the green button to turn on your Security Device and then create a 4- to 8-digit PIN for it.

- Press the yellow button and re-enter your new PIN to confirm it.

- When you see "HSBC" displayed on the Security Device screen, press the green button to generate a security code.

- Enter this Security Code on the online banking page and click "Continue" to complete the activation process.

I am seeing the "Activate your Security Device" screen every time I log on. Do I have to activate my Security Device?

Yes, you are required to activate your Security Device to access more banking features with HSBC Malaysia online banking. You need to activate your Security Device within 30 days from the order placement date, otherwise you will not have full access to all your HSBC Malaysia online banking features until your Security Device has been activated.

Account summary

What are the changes on the new HSBC Malaysia online banking homepages?

Upon logging on to the new HSBC/HSBC Amanah debit card profile online banking page, you will be directed to the homepage. On this page you can:

- See a new and refreshed homepage design

- See your last log on date and time on the homepage

- View all your local and international accounts in one view

- Check account details - account balance, available balance and last 3 transactions

- Check your account transaction history - date, amount and description of transactions

Payments and transfers

What is Move Money?

Move Money is a single place for managing all your transfers from your HSBC/HSBC Amanah accounts worldwide.

With Move Money, you can perform the following transactions:

- Transfer money between your own accounts and credit cards, other HSBC/HSBC Amanah accounts and third-party accounts domestically and internationally in local currencies and other supported foreign currencies

- Save a payee easily for future transfers

- Send money to an existing payee or add a new payee

- Set up an immediate transfer, dated or recurring transfer

When will my transactions show on HSBC Online Banking?

| Payment initiated by customer | Transaction Date Displayed under Transaction History in Online Banking and Account Statement |

|---|---|

Sunday - Friday (12am-10pm) |

Actual date the payment was performed |

Sunday - Thursday (after 10pm) |

Next working day |

Friday (after 10pm*) |

Date of the upcoming Sunday* |

Saturday (whole day) |

Date of the upcoming Sunday* |

Public Holidays |

Next working day |

| Payment initiated by customer |

Sunday - Friday (12am-10pm) |

|---|---|

| Transaction Date Displayed under Transaction History in Online Banking and Account Statement |

Actual date the payment was performed |

| Payment initiated by customer |

Sunday - Thursday (after 10pm) |

| Transaction Date Displayed under Transaction History in Online Banking and Account Statement |

Next working day |

| Payment initiated by customer |

Friday (after 10pm*) |

| Transaction Date Displayed under Transaction History in Online Banking and Account Statement |

Date of the upcoming Sunday* |

| Payment initiated by customer |

Saturday (whole day) |

| Transaction Date Displayed under Transaction History in Online Banking and Account Statement |

Date of the upcoming Sunday* |

| Payment initiated by customer |

Public Holidays |

| Transaction Date Displayed under Transaction History in Online Banking and Account Statement |

Next working day |

*If Sunday is a Public Holiday, the transaction date shown will be the next working day.

I can't find the 'in-house transfer' and 'worldwide transfer' options on the HSBC Malaysia online banking pages. What should I do?

The “in-house transfer” option has been renamed “HSBC account” and “worldwide transfer” has been renamed “Overseas account”. You can execute in-house transfers and worldwide transfers by going to "Move money" and selecting the "Pay and transfer" option in HSBC Malaysia online banking.

Making a fund transfer using the "HSBC account" option refers to transfers between your HSBC/HSBC Amanah accounts and/or transfers to other HSBC/HSBC Amanah accounts in Malaysia.

Making a fund transfer using the "Overseas account" option refers to transfers to your own account outside of Malaysia or transfers to an overseas beneficiary.

Online banking limits

How do I change my daily online banking limit?

You may increase or decrease your daily limit by logging on to online banking and selecting the ‘Change online banking limit’ option under 'Quick Links'.

12-hour cooling-off period

From 17 November 2024 onwards, there's a 12-hour cooling-off period for any transaction limit increase request via HSBC Malaysia Online Banking.

During the 12-hour cooling-off period, you can’t make further changes to your limits. However, you can still perform transactions within your existing transaction limits.

Your new limit will be effective after this period. If you need further assistance, please visit your nearest branch or call our Contact Centre.

The cooling-off period does not apply to limit reduction and your new limit will be effective immediately.

What are the maximum and default limit amounts for each type of transaction?

| Limit Types | Maximum limit |

Default limit (for new-to-bank customers) |

|---|---|---|

| Own account transfers |

Unlimited |

Unlimited |

Third party HSBC transfer |

RM100,000 | RM5,000 |

Overseas telegraphic transfer & Global Money Transfer (Shared limit) |

RM200,000 | RM5,000 |

| Interbank GIRO (IBG)* | RM50,000* | RM1,000 |

| DuitNow (Online Banking)* | RM50,000* | RM1,000 |

| DuitNow (Mobile Banking)* | RM50,000* | RM1,000 |

| DuitNow QR* | RM50,000* | RM1,000 |

| FPX* | RM50,000* | RM1,000 |

Bill Payments (JomPAY) |

RM50,000 | RM1,000 |

| Limit Types |

Own account transfers |

|---|---|

| Maximum limit |

Unlimited |

| Default limit (for new-to-bank customers) |

Unlimited |

| Limit Types |

Third party HSBC transfer |

| Maximum limit |

RM100,000 |

| Default limit (for new-to-bank customers) |

RM5,000 |

| Limit Types |

Overseas telegraphic transfer & Global Money Transfer (Shared limit) |

| Maximum limit |

RM200,000 |

| Default limit (for new-to-bank customers) |

RM5,000 |

| Limit Types | Interbank GIRO (IBG)* |

| Maximum limit |

RM50,000* |

| Default limit (for new-to-bank customers) |

RM1,000 |

| Limit Types | DuitNow (Online Banking)* |

| Maximum limit |

RM50,000* |

| Default limit (for new-to-bank customers) |

RM1,000 |

| Limit Types | DuitNow (Mobile Banking)* |

| Maximum limit |

RM50,000* |

| Default limit (for new-to-bank customers) |

RM1,000 |

| Limit Types | DuitNow QR* |

| Maximum limit |

RM50,000* |

| Default limit (for new-to-bank customers) |

RM1,000 |

| Limit Types | FPX* |

| Maximum limit |

RM50,000* |

| Default limit (for new-to-bank customers) |

RM1,000 |

| Limit Types |

Bill Payments (JomPAY) |

| Maximum limit |

RM50,000 |

| Default limit (for new-to-bank customers) |

RM1,000 |

*Daily Combined Limit applied.

Please take note that although you are allowed to increase limit up to RM50,000 for each IBG, DuitNow (Online Banking, Mobile Banking, QR) and FPX, all of them are subject to the Daily Combined Limit of RM50,000.

For example, if you have transferred RM50,000 via IBG, you would not be able to make any third party transfer via DuitNow (Online Banking, Mobile Banking, QR) or FPX transactions within the same day.

Daily combined limit

Effective 11 June 2023, as part of your account safety and security measures, the Daily Combined Limit for all DuitNow (Online Banking, Mobile Banking and QR) transfers, Interbank GIRO (IBG) and FPX is RM50,000.

This Daily Combined Limit is not applicable to transfers between own account, HSBC accounts and Overseas transfers.

Here are some examples:

If you’ve made a DuitNow Transfer of RM30,000 either via Online Banking, Mobile Banking or QR Pay, you can only transfer up to RM20,000 via DuitNow/IBG and FPX payment on the same day.

If you’ve made an IBG transfer of RM50,000, you will not be able to make any more fund transfers via DuitNow/IBG/FPX on the same day.

If you wish to transfer above RM50,000 within same day, please visit the nearest HSBC branch or ATM.

Click here to locate one.

Time/Term Deposit/-i

I received an error message saying my Common Reporting Standard (CRS) details are incomplete. What should I do?

We will need you to submit your CRS declaration. Before that, please ensure that your email address is updated or registered with us for your CRS declaration to be accepted. If your email address is not updated or registered with the Bank, please do so at www.hsbc.com.my/online/personaldetails/.

Thereafter, please follow these steps:

- Log on to Online Banking.

- Go to 'Services' at the top menu, under 'Tools & Services' select 'Update CRS status'.

- Complete the 'CRS Individual Self-Certification' form, enter your digital signature and follow the form instructions before submitting.

- Once you have submitted the CRS form declaration and have not received a further reply via email from crsbo@hsbc.com.my after 5 working days, it is deem as accepted and you can place a Time/Term Deposit/-i via online.

- If the problem persists, please reach out to us via Contact Us at https://www.hsbc.com.my/contact/.

Manage future requests / recurring payments

Can I amend recurring / future dated payments?

Current online banking features allow only the "view" and "delete" functions. To amend a payment, please delete the existing payment and set up a new payment.

Manage your payees

What is the difference between the previous "view/delete payees" and the new "view/delete beneficiaries" functions?

The look and feel of the functions have been enhanced to provide a better user experience.

Secure messages

What can I do with the secure messages feature?

You will be able to access your inbox and view your available messages.

Linking your global accounts

What is the purpose of linking my accounts via the Global View feature?

If you have another HSBC account outside Malaysia, this feature allows you to view your global accounts all in one convenient online location, rather than having to log on to the offshore account separately.

JomPay

What is JomPAY?

JomPAY is a national initiative, supported by banks, to enable online bill payments across Malaysia. PayNet, a wholly owned subsidiary of Bank Negara Malaysia, operates JomPAY.

DuitNow

Why should I use DuitNow?

With DuitNow, you can send and receive money instantly at any time using the recipient's DuitNow ID such as their mobile number, NRIC number, passport number, Business Registration Number (BRN) or Army/Police number. You won't need their account details to make a transfer.

DuitNow Online Banking/Wallets

What is the daily transfer limit for DuitNow Online Banking/Wallets (DOBW)?

The daily transfer limit for DOBW is MYR50,000. It is shared with the DuitNow (Online Banking) limit and subject to the Daily Combined Limit. For more information on Online Banking limits, please see our Online Banking FAQs.

Which account type is supported for DOBW?

HSBC/HSBC Amanah current and savings accounts/-i are the types of account currently supported for DOBW.

Do I need to pay any fees and charges for using DOBW?

No, there will be no fee and charges imposed for using DOBW.

FPX

What is the purpose of the FPX feature?

It allows you to make payments using your HSBC/HSBC Amanah accounts for purchases made on third-party merchant sites.

Communication preferences

When do changes take place after changing my communication preferences?

Changes will be effective immediately.