What is Cash Instalment Plan?

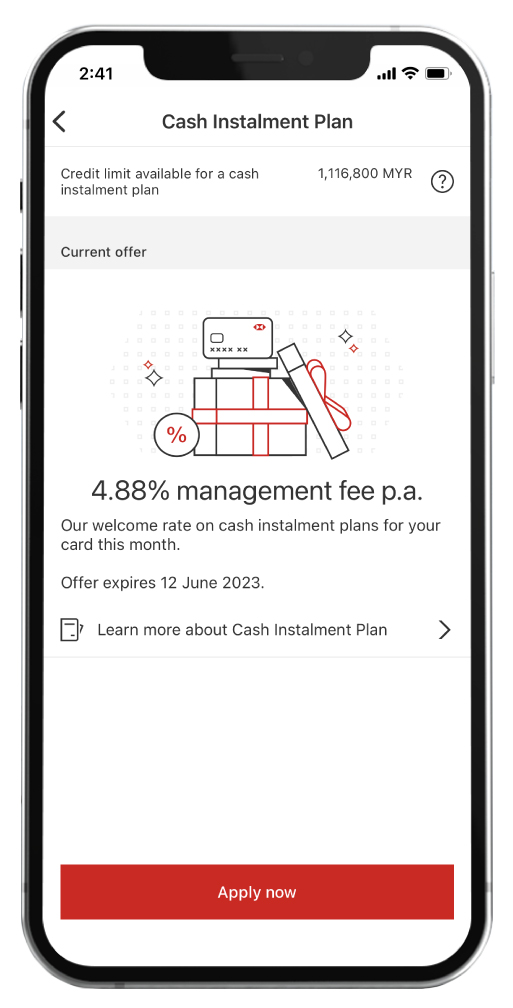

Cash Instalment Plan (CIP) allows you to get cash from your available credit limit and pay at affordable monthly instalment. With Cash Instalment Plan now available via HSBC Malaysia Mobile App, you can get the cash you need in just few taps with instant approval.

Benefit at a glance

- Quick and easy access to cash when you need it

- Flexible payment tenures of up to 60 months

- Competitive interest rate

- No documents required for application

New to online banking?

Download and apply via HSBC Malaysia app

How to apply for a CIP

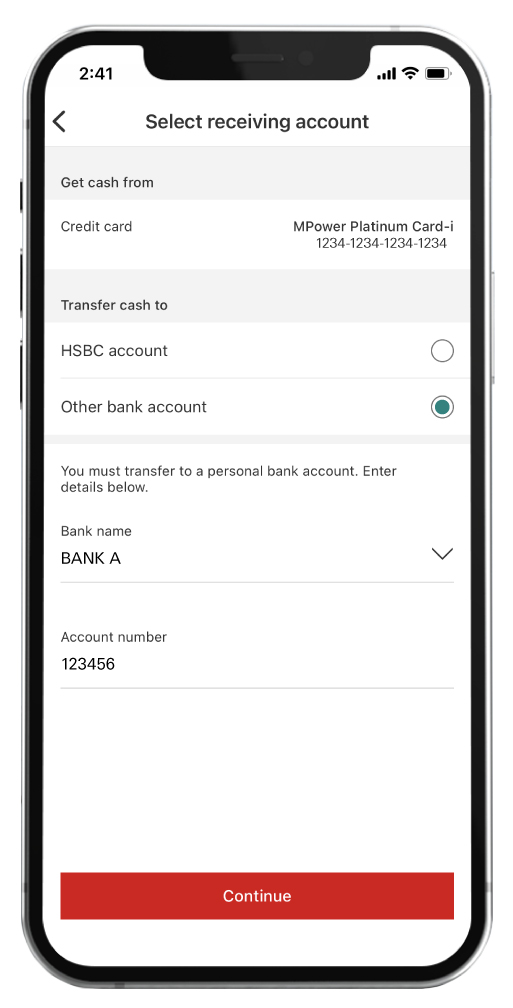

Apply in few simple steps:

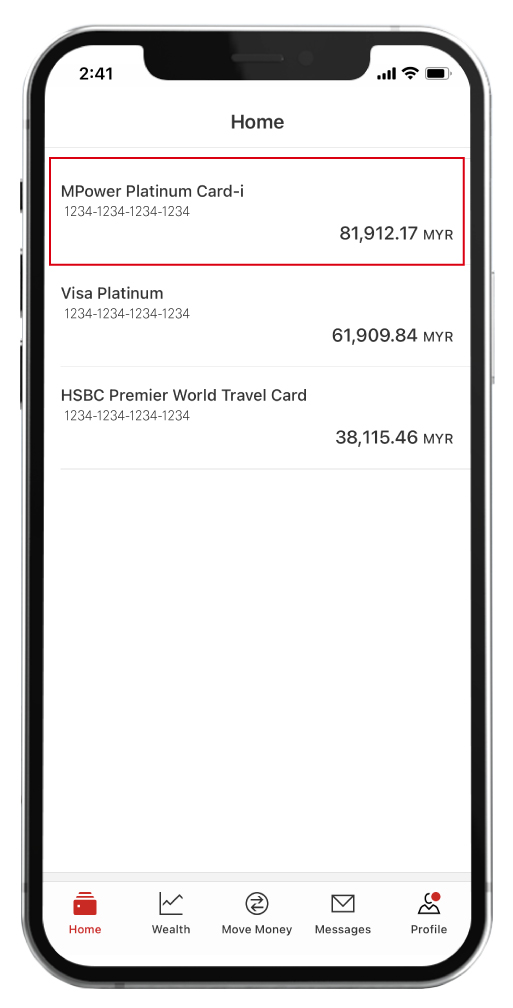

- Log on to HSBC Malaysia Mobile App

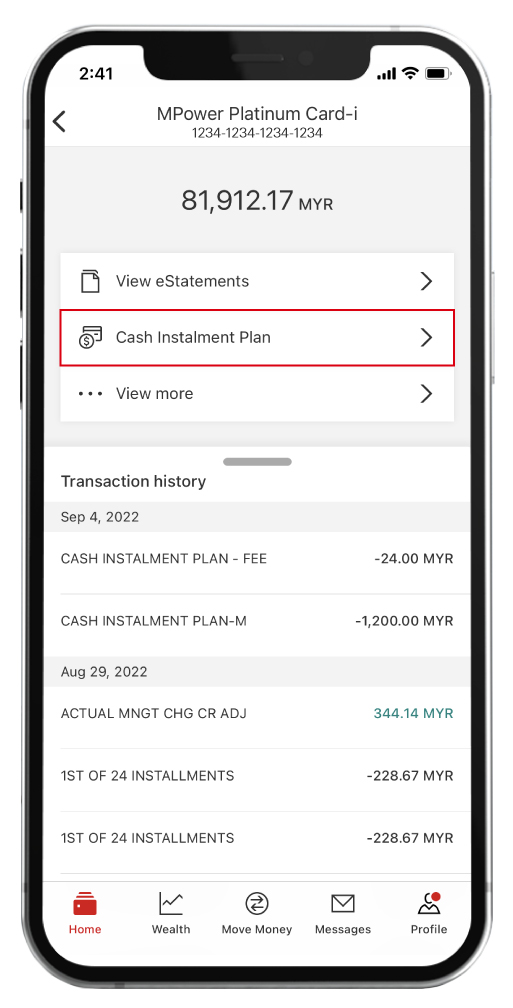

- Select your credit card and then 'Cash Instalment Plan'

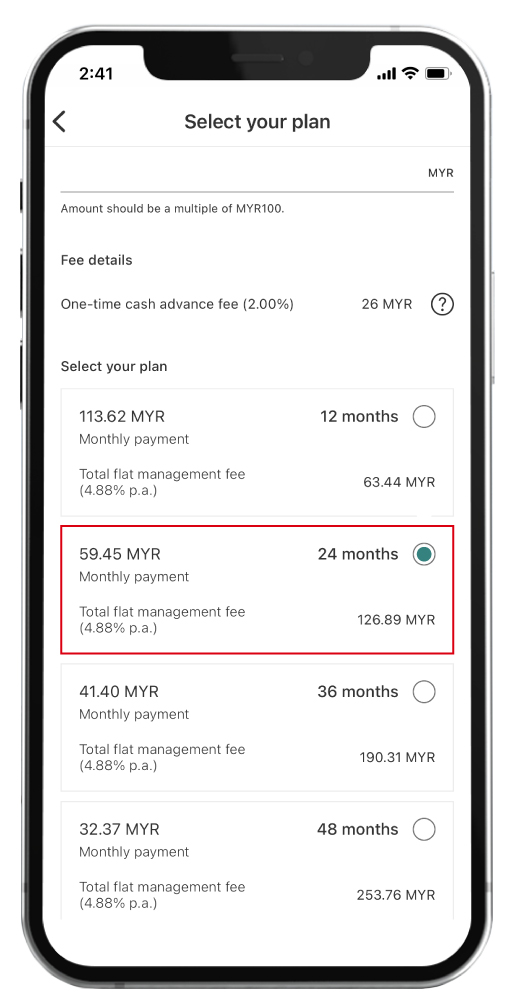

- Select your plan and enter the CIP amount, then select 'Confirm and Accept T&C'

Alternatively, you can click on the button below to submit the form for a call back.

Example of CIP Monthly Instalment amount:

| CIP amount (RM) 6.88%p.a. | 12 months | 24 months | 36 months | 48months | 60 months |

|---|---|---|---|---|---|

| 1,000 | 89.07 | 47.40 | 33.51 | 26.57 | 22.40 |

| 3,000 | 267.20 | 142.20 | 100.53 | 79.70 | 67.20 |

| 5,000 | 445.33 | 237.00 | 167.56 | 132.83 | 112.00 |

| 8,000 | 712.53 | 379.20 | 268.09 | 212.53 | 179.20 |

| 15,000 | 1,336.00 | 711.00 | 502.67 | 398.50 | 336.00 |

| CIP amount (RM) 6.88%p.a. | 1,000 |

|---|---|

| 12 months | 89.07 |

| 24 months | 47.40 |

| 36 months | 33.51 |

| 48months | 26.57 |

| 60 months | 22.40 |

| CIP amount (RM) 6.88%p.a. | 3,000 |

| 12 months | 267.20 |

| 24 months | 142.20 |

| 36 months | 100.53 |

| 48months | 79.70 |

| 60 months | 67.20 |

| CIP amount (RM) 6.88%p.a. | 5,000 |

| 12 months | 445.33 |

| 24 months | 237.00 |

| 36 months | 167.56 |

| 48months | 132.83 |

| 60 months | 112.00 |

| CIP amount (RM) 6.88%p.a. | 8,000 |

| 12 months | 712.53 |

| 24 months | 379.20 |

| 36 months | 268.09 |

| 48months | 212.53 |

| 60 months | 179.20 |

| CIP amount (RM) 6.88%p.a. | 15,000 |

| 12 months | 1,336.00 |

| 24 months | 711.00 |

| 36 months | 502.67 |

| 48months | 398.50 |

| 60 months | 336.00 |

Who's eligible for CIP?

- HSBC/HSBC Amanah Principal credit cardholders

- Active primary credit card account holders with no overdue payments and good credit standing

Frequent Ask Question

Things you should know

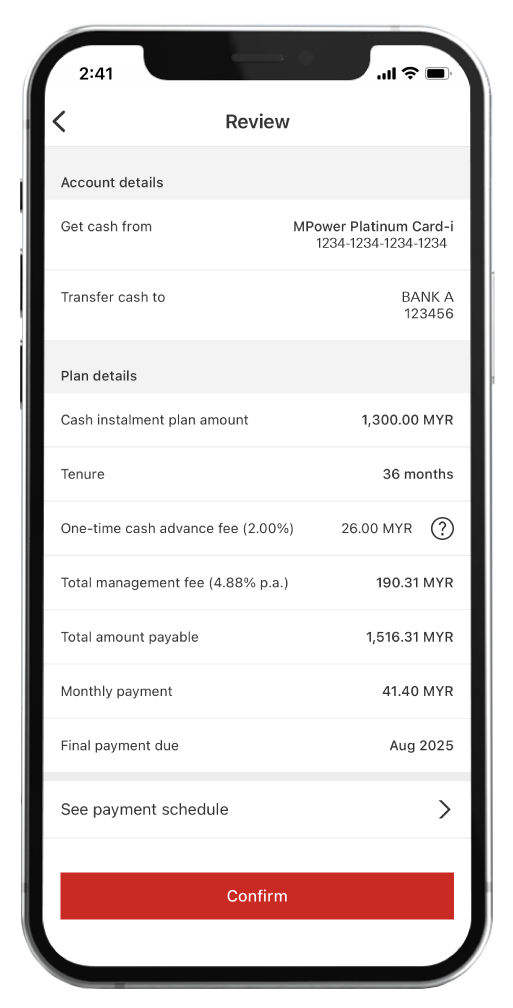

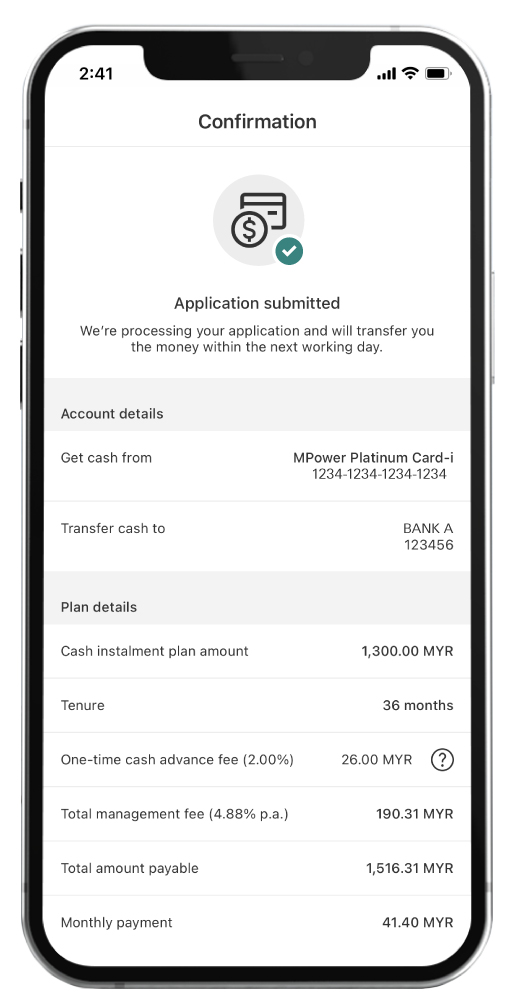

The minimum amount for each Cash Instalment Plan ("CIP") application to qualify for this programme is RM1,000 and the amount must be in multiples of RM100. A 2% cash advance fee will be charged if the CIP amount is below RM5,000. The Eligible Cardholder shall pay 100% of the CIP monthly Instalment which is part of the Minimum Monthly Payment due on or before the payment due date. The interest rate offered is subject to HSBC's approval. The terms used herein are as defined in the HSBC Cash Instalment Plan Terms and Conditions.

Please read the PDFs below for corresponding full terms and conditions.

You may also be interested in

Balance Transfer Instalment (BTI)

Consolidate all of the outstanding balances from your other credit cards to your HSBC credit card.

Balance Conversion

Convert your retail transactions or balances to affordable monthly instalments.

Card Instalment Plan

Enjoy 0% interest instalment.