HSBC Time Deposit

Key Benefits and Privileges

- Higher returns than an ordinary savings accountEnjoy fixed and competitive deposit rates from 2.45% - 2.55% p.a.

- Flexible deposit amounts and tenuresMake flexible placement from as low as RM1,000 (2 months and above) or RM5,000 for 1 month

- Easy to openOnline account opening in a few simple steps. It's a paperless application - simple and convenient

Interest Rate

| Tenure (month) |

Interest rate (% p.a.) |

|---|---|

| 1 - 2 | 2.45% |

| 3 - 11 | 2.50% |

| 12 - 60 | 2.55% |

| Tenure (month) |

1 - 2 |

|---|---|

| Interest rate (% p.a.) | 2.45% |

| Tenure (month) |

3 - 11 |

| Interest rate (% p.a.) | 2.50% |

| Tenure (month) |

12 - 60 |

| Interest rate (% p.a.) | 2.55% |

Minimum deposit of RM5,000 for one (1) month tenure or RM1,000 for tenure of two (2) months and above.

If you withdraw your time deposit before its maturity date, whether you'll get an interest payment or not depends on the placement or renewal date:

For time deposits placed or renewed before 1 March 2025:

- Interest will be paid at half the contracted rate for each completed month for time deposits held 3 months or longer

- No interest will be paid for time deposits held less than 3 months

For time deposits placed or renewed on or after 1 March 2025:

No interest will be paid if the respective full tenure period of a time deposit is not completed.

Payment of interest upon maturity:

- For deposit at or over 13 months, interest can be credited every half-yearly if required.

The payment of interest, if any, shall be paid:

- On the maturity date; or

- At periodic intervals at the Bank's discretion.

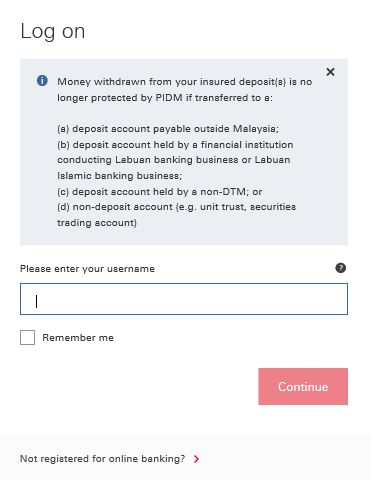

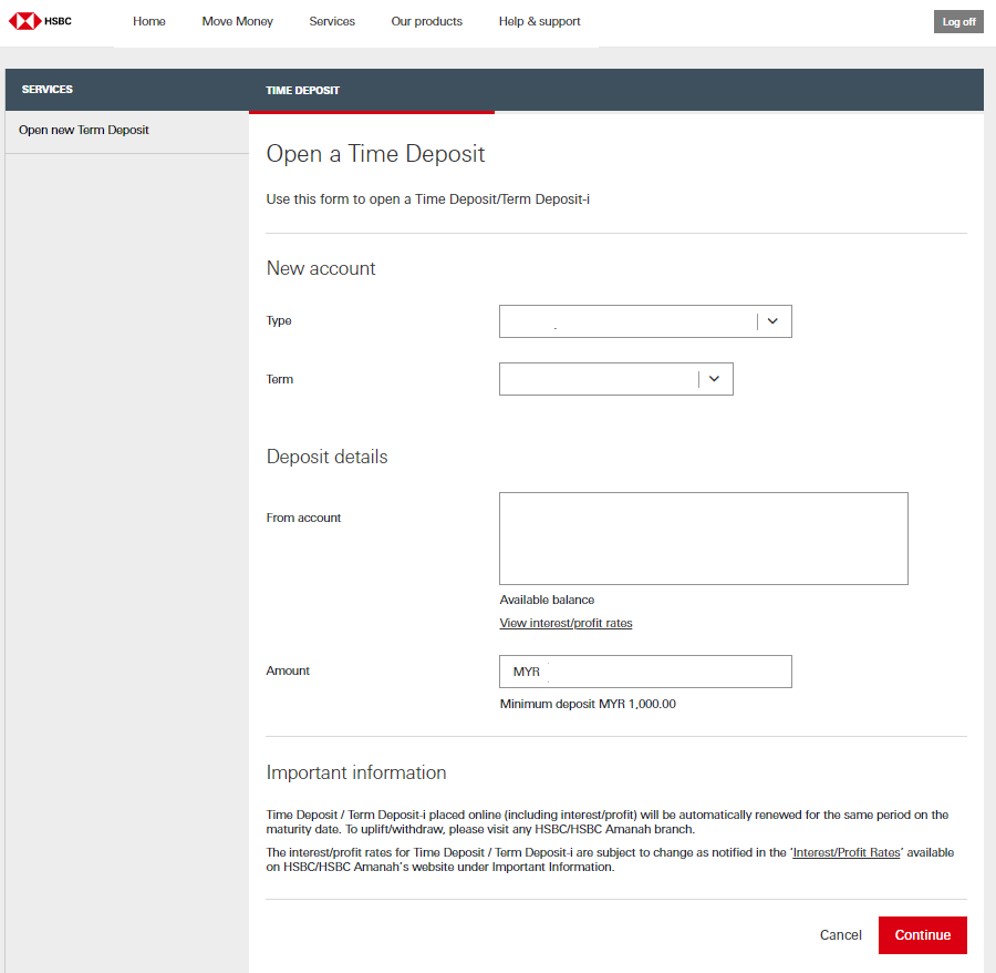

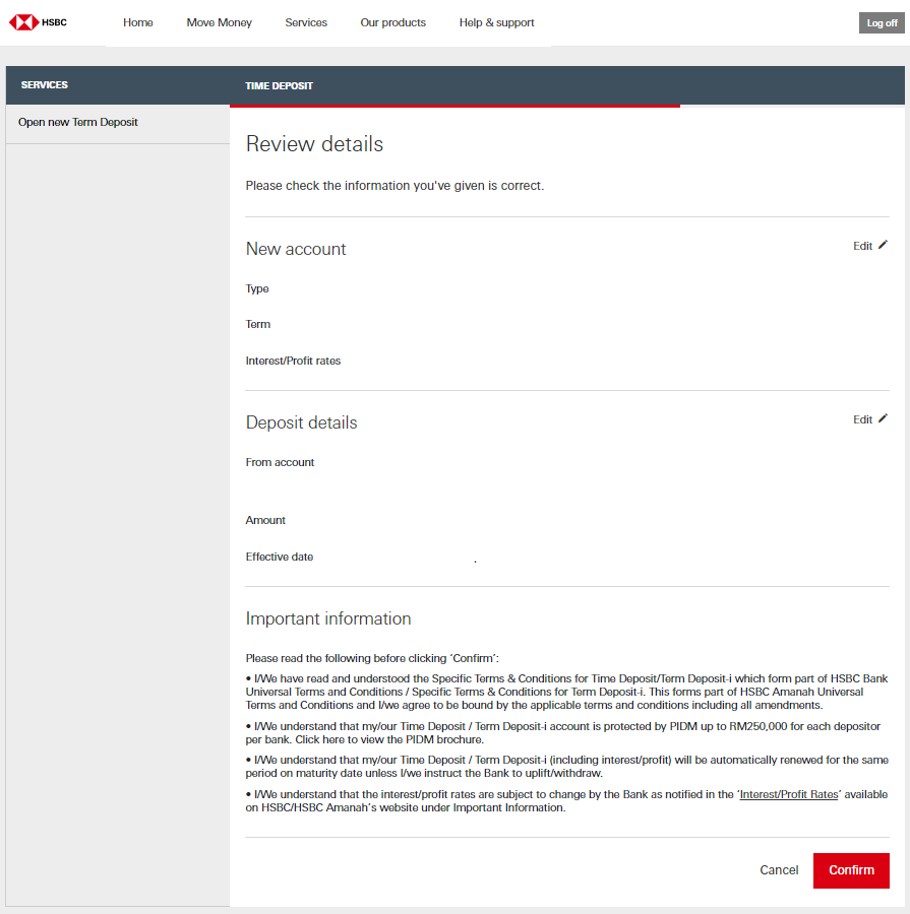

How to place Time Deposit online in 3 simple steps

Apply online in minutes

Existing HSBC customer

New to HSBC

Prerequisite of opening time deposit account is to have at least one HSBC savings or current account.

Things you should know

- Customer must have at least one HSBC current account or savings account

- Minimum deposit amount: RM5,000 for 1 month or RM1,000 for 2 months and above

- Member of Perbadanan Insurans Deposit Malaysia

Protected by Perbadanan Insurans Deposit Malaysia up to RM250,000 for each depositor*.

*Click here for more details on PIDM protection.

Frequently asked questions

Compare Savings Accounts

You might also be interested in

Save, spend and transact in 11 currencies with 1 account

Open an Everyday Global Account today.

Premier services and support

Enjoy global benefits and worldwide assistance with HSBC Premier.

T&Cs apply.