Table of content

- Steps to complete identity verification at Self-Service Machine Click to Steps to complete identity verification at Self-Service Machine

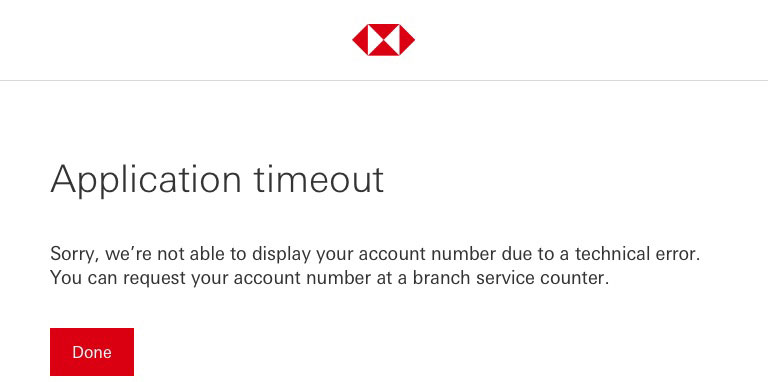

- Next steps upon encountering issues during biometric verification

- Frequently asked questions about online application click to who can open an account online

How to complete identity verification at Self-Service Machine after you've submitted online application?

Who can open an account online?

You must meet the following criteria to open an account online:

- You are 18 or above

- You are a citizen of Malaysia with a valid MyKad

- You are applying for a sole account

- You don’t have an existing account or credit card with us

If you do not meet the above criteria, please visit us in branch click to go to branch finder page. to open an account.

How do I open an account online?

Simply complete the online application form.

You’ll then receive an email notification asking you to confirm your identity at one of our Self-Service Machines or branches click to go to branch finder page..

We may also contact you for additional information if necessary.

What type of accounts are available for online account opening?

You can learn more about the types of accounts available here to HSBC Malaysia account page.. If your preferred type of account cannot be opened online, please visit us in branch.

How much do I need to deposit after account opening?

| Product Description |

Amount (RM) |

|---|---|

| HSBC Premier Account |

1,000 |

| HSBC Amanah Premier Account-i |

1,000 |

| HSBC Advance Account |

500 |

| HSBC Amanah Advance Account-i |

500 |

| HSBC Basic Current Account |

500 |

| HSBC Amanah Basic Current Account-i |

500 |

| HSBC Basic Savings Account |

20 |

| HSBC Amanah Basic Savings Account-i |

20 |

| Product Description |

HSBC Premier Account |

|---|---|

| Amount (RM) |

1,000 |

| Product Description |

HSBC Amanah Premier Account-i |

| Amount (RM) |

1,000 |

| Product Description |

HSBC Advance Account |

| Amount (RM) |

500 |

| Product Description |

HSBC Amanah Advance Account-i |

| Amount (RM) |

500 |

| Product Description |

HSBC Basic Current Account |

| Amount (RM) |

500 |

| Product Description |

HSBC Amanah Basic Current Account-i |

| Amount (RM) |

500 |

| Product Description |

HSBC Basic Savings Account |

| Amount (RM) |

20 |

| Product Description |

HSBC Amanah Basic Savings Account-i |

| Amount (RM) |

20 |

How to make an initial deposit?

You can deposit the minimum amount into your new account by transferring the funds online from another bank. Alternatively, you can use our cash deposit machines or visit us in branch.

When can I start using and transferring funds into my account?

You can start using and transferring funds into your account as soon as we’ve confirmed your identity at one of our Self-Service Machines or branches click to go to branch finder page..

Account number will be provided or displayed on our Self-Service Machine.

Can I apply for multiple accounts in one application?

You can only apply for one (1) account per online application.

How long does it take to open an account online?

It takes approximately 10 minutes to complete the online application form.

You’ll then receive an email notification asking you to confirm your identity at one of our Self-Service Machines or branches click to go to branch finder page..

It’s important for you to visit a Self-Service Machine or branch as soon as you can to confirm your identity, as your application will expire 30 days from the date you submit your online application.

Can I save an unfinished application and complete it later?

No, you need to complete your application within one (1) session.

I accidentally closed the window in the middle of the account opening process. What should I do?

If you closed the window before you submit the application, you'll need to restart a new application.

Can I change the information in my application after I’ve submitted it online?

If you would like to change the information in your application after you’ve submitted it online, please visit us in branch.

What happens after I submit my application online?

You will be told whether your application was successful as soon as you submit the form.

You’ll then receive an email asking you to confirm your identity at one of our Self-Service Machines or branches click to go to branch finder page..

It’s important for you to visit a Self-Service Machine or branch as soon as you can to confirm your identity, as your application will expire 30 days from the date you submitted your application.

What do I need to bring when I visit a Self-Service Machine or branch?

If you’re using a Self-Service Machine to confirm your identity, please bring your MyKad.

You should also bring other identification documents (e.g. driving license and passport) in case of any technical issue, where manual verification will be done at branch counter (during branch opening hours).

We’ll contact you if any supporting document is required.

Can I withdraw my application after I’ve submitted it?

Please contact one of our branches if you wish to withdraw your application.

How do I get my debit card?

You’ll need to confirm your identity at one of our Self-Service Machines or branches click to go to branch finder page..

Once we have confirmed your identity, your debit card will be delivered by courier to you within 3-6 working days.

You can learn more about the debit card here to HSBC Malaysia debit card page..

How can I check the delivery status of debit card?

Tracking number will be sent to you via SMS. Alternatively, you may request delivery tracking number by calling 03-8321 5400.

How do I register for online/internet banking?

Upon successfully opening an account, you can register for Online Banking here to HSBC Malaysia register page. using Debit card or telebanking PIN.

Learn more about how to register here to HSBC Malaysia register page..

You may request security device through:

- Contact Centre, please call us on 03-8321 5400 or

- Branch

You’ll need this to make transfers to a third party. Your security device will then be delivered to you by post within 3 to 6 working days.

How do I order a chequebook?

If you would like to order a chequebook, please visit us in branch click to go to branch finder page..

Who do I contact if I need help?

If you need any help, call us on 03-8321 5400 or visit us in branch click to go to branch finder page..

Alternatively, you can refer to the online application guide here.